💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

The 9 Best Payroll Software for Restaurants 2023

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

The bottom line: Our favorite payroll software for restaurants is SurePayroll, with Square Payroll a close second. But there are more than just two options for restaurant owners like you: read on for our reviews of the nine best payroll software for restaurants.

The 5 best payroll software for restaurants

- : Best overall

- : Most convenient

- : Most user-friendly

- : Most affordable

- : Best customer service

SurePayroll: Best overall payroll software for restaurants

Starting at $19.99/mo. + $4.00/mo./payee

With its restaurant-specific assistance (including minimum wage alerts and makeup tip options), low starting price of just $19.99 a month, and automatic payroll tax payments, SurePayroll is an affordable, comprehensive payroll solution for restaurant owners.

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

SurePayroll is one of our favorite payroll providers for all types of small businesses, and it's particularly good for restaurants.

For one thing, its low starting price of $19.99 a month makes it one of the cheapest payroll solutions on the market. For another, it offers a sweeping amount of payroll features and restaurant-specific payroll features that make processing payroll as simple as possible, including these:

- Automatic minimum wage alerts when an employee’s tips don’t meet federal wage requirements

- Makeup tip options for when employees’ tips for a given pay period don’t meet federal wage requirements

- Tip sign-off reports, which record your employees’ tip declarations so you can demonstrate federal compliance

- FICA tip credit report access, which shows your eligibility for federal tax savings based on the FICA tip credit

SurePayroll also has US-based phone, chat, and email support beyond regular business hours. You can get payroll help on weekends and evenings, which is a rarity in the payroll software world.

SurePayroll's $19.99 plan is a self-service plan, meaning SurePayroll calculates payroll taxes, but you're responsible for remitting the taxes to the federal government and filing end-of-year paperwork. If you want automatic payroll tax filing, you'll need the full-service plan, which starts at $29.99 a month plus $5 per payee.

While you can run multi-state payroll with SurePayroll, doing so costs an extra $9.99 a month (which is a flat fee for two or more states—not a per-state charge). That fee isn't bad, but if you're a franchisee with restaurants in multiple states, Gusto's free multi-state payroll could save you a bit of cash. And since SurePayroll has just two plans, it's not as scalable for rapidly growing businesses as, say, ADP or Paychex.

Square Payroll: Most convenient

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

Are you already using Square Point of Sale for its floor plan, menu, and discount features? Square Payroll syncs seamlessly with every other app in the Square suite of products, which makes it a logical next step for your business.

For instance, if your employees use Square Point of Sale to clock in and out, the data seamlessly syncs with the payroll software for easy paycheck calculation. Square Payroll lets you import and split tips left with credit cards. And like SurePayroll, Square Payroll comes with an employer-facing app—one of only five payroll providers to do so.

Square Payroll is also super accessible for employees. With the Square Team app, your chefs and waitstaff can update their tax info, check pay stubs, clock in and out, and specify their preferred payment method. And (logically enough), Square Payroll syncs with the Square Cash App so you can easily pay mobile-first employees.

By signing up I agree to the Terms of Use and Privacy Policy.

OnPay: Most user-friendly

Starting at $40.00/mo. + $6.00/payee/mo.

With next to no learning curve, OnPay’s payroll software is super intuitive and easy to use for employers and employees alike. And with restaurant-specific features and near total automation, OnPay simplifies payroll better than just about any software provider.

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

At $40 per month, OnPay is a tiny bit pricier than our picks thus far. But OnPay’s restaurant-specific focus makes the few extra dollars worth your while:

- Minimum wage tip makeup

- Form 8846 preparation for FICA tip credit

- Simple overtime calculation

- Free multi-state payroll

What really sets OnPay apart is how easy the software is to learn and use. (You don't have to take our word for it: OnPay's customers agree.) New hires can quickly upload their tax forms and bank information for direct deposit with minimal hassle. OnPay also goes out of its way to keep extra charges off your plate: you can run payroll as much as you like without being penalized for off-cycle or holiday payroll runs.

However, OnPay runs into the same problem as other single-plan payroll software like SurePayroll and Square Payroll: it's not that scalable. The features you see are the features you get, no matter how many employees you hire—and while those features are pretty great, they might not be enough for hundreds of employees rather than a dozen. If you want more expansive, HR-based plans that scale up as you grow, Gusto, ADP, and Paychex are all better fits.

Wave Payroll: Most affordable accounting software integration

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

Wave Payroll doesn’t necessarily include restaurant-specific features, but its general payroll services pack a punch regardless of your industry:

- Employee self-service portals (employees can access their own W-2s and pay stubs)

- Workers compensation coverage options

- Easy check printing and direct deposit

- Vacation and sick day payment integration

In most states, though, Wave Payroll costs just $20 because you have to file your own payroll taxes. While Wave Payroll can calculate the tax amounts for you and even withhold them from your employees’ paychecks, you’ll have to go through the trouble of submitting the forms on your own.

Honestly, the main reason to choose Wave Payroll is its integration with Wave’s free accounting software—it's completely free without sacrificing quality for pricing. In fact, its comprehensive accounting features and user-friendliness rival those of established providers like QuickBooks Online.

Inova Payroll: Best customer service

Inova Payroll isn’t as well known as most of the other providers on our list; it was founded fairly recently (for payroll software, at least) in 2010. But Inova Payroll includes a host of features—easy POS integration, overtime and tip calculations, and new hire and ACA compliance reporting—that make it worth looking into.

But Inova Payroll’s most standout feature is its dedicated customer service structure. When you sign up with Inova, you’ll be assigned a dedicated customer service representative—or even a customer service team—who will get to know your business about as well as you do. When you need help, you can turn to your dedicated representative instead of waiting in an anonymous phone queue.

Of course, the trade-off for dedicated customer care is usually a higher price . . . and Inova Payroll doesn’t list any pricing on their site. You’ll have to contact the company for a customized quote, which likely means Inova charges more than some of our other payroll provider picks.

Honorable mentions

Need more options? Here are four more restaurant payroll software choices you can consider.

Top feature comparison: Honorable mentions

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

More restaurant payroll picks

Need more options? Here are four more restaurant payroll software choices you can consider.

Gusto: Best HR add-ons

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

Starting at $40 a month, Gusto is pretty reasonably priced, especially considering its automated payroll processing, new hire reporting, and even child support wage garnishments. Even its most basic plan includes health benefits and workers comp support, which we think justifies the $6 charge per employee.

Gusto’s mid-tier plan bundles payroll basics with timekeeping software, employee self-service onboarding, time-off requests, and PTO features. Its most expensive plan gives you access to a dedicated HR consultant and a host of HR resources.

Paycor: Best for franchises

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

As a total human capital management (HCM) solution, Paycor offers payroll plus an easy onboarding process, HR software, benefits administration, time and attendance, and learning management system options. If you’re looking for an all-in-one HR solution for your expanding franchise—and you’re willing and able to pay extra for the heftier HR lift—Paycor could be a good bet.

Paychex Flex: Best for bigger restaurants

Data as of 11/11/22. Offers and availability may vary by location and are subject to change.

Worried about sharing tips equally among dozens of tipped employees? Paychex’s Tip Network pools tips for easy division at the end of employee shifts; it bypasses direct deposit by loading tips onto prepaid debit cards called paycards.

SurePayroll is a Paychex company, so if you like SurePayroll but need a more robust solution for an expanding company (and are fine paying a higher monthly fee), Paychex Flex shouldn’t demand a huge learning curve.

RUN Powered by ADP: Most package options

Most of our top five providers offer one package with one base price and a standard charge for each payee. Not so with RUN Powered by ADP, which markets four packages with differing levels of human resources (HR) support. To get more pricing information on RUN Powered by ADP, you have to request a quote with fairly detailed company information. Based on the quote request and expanded HR services, we assume RUN Powered by ADP is one of the more expensive payroll service providers.

The takeaway

Thanks to tip calculation and payroll taxes, running payroll probably won’t ever be a breeze at your restaurant. But the right payroll provider—whether that’s SurePayroll, Square Payroll, or Wave Payroll—can take the hardest parts of payroll off your hands, leaving them free to slice, dice, and sauté your way into your customers’ hearts . . . or, at the very least, their stomachs.

Want to learn more about how payroll works? Our article on how to run payroll can point you in the right direction.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Related reading

Our methodology

To evaluate the best payroll software for restaurants, we looked at these key criteria and ranked our payroll brands accordingly:

- Affordability. Is the software reasonably priced for its features? Does the software company list their pricing online and up front, or do you have to contact the company for a quote?

- Accessibility. How easy is the software for employers to navigate? Does the software have an app for employers to pay employees on the go?

- Customer service. Can customers reach the company for help 24/7 or simply during business hours?

- Industry specifics. Does the payroll software offer restaurant-specific features, support, or resource guides?

- Payroll features. Does the software include HR options, payroll tax automation, and third-party integrations (for instance, with accounting software like Xero or QuickBooks)?

We weighted all five categories equally, along with our expert's informed opinion, to calculate our star ratings.

Best payroll software for restaurants FAQ

We recommend SurePayroll as the best payroll software for restaurants. This comes down to its affordability and restaurant-specific payroll features. But it has many other general payroll features, which is why it's on our list of the best payroll software for small businesses.

The most popular payroll software is Gusto, and while we don't pick this as our favorite for restaurants, we can understand why it's so well-liked. After all, it's our top pick for the best payroll software for small business. Some of the many reasons we chose it as our favorite general top pick include its fair pricing, scalable plans, comprehensive features, automatic payroll tax administration, and affordable insurance options. It also has great HR resources on its higher-tier plan.

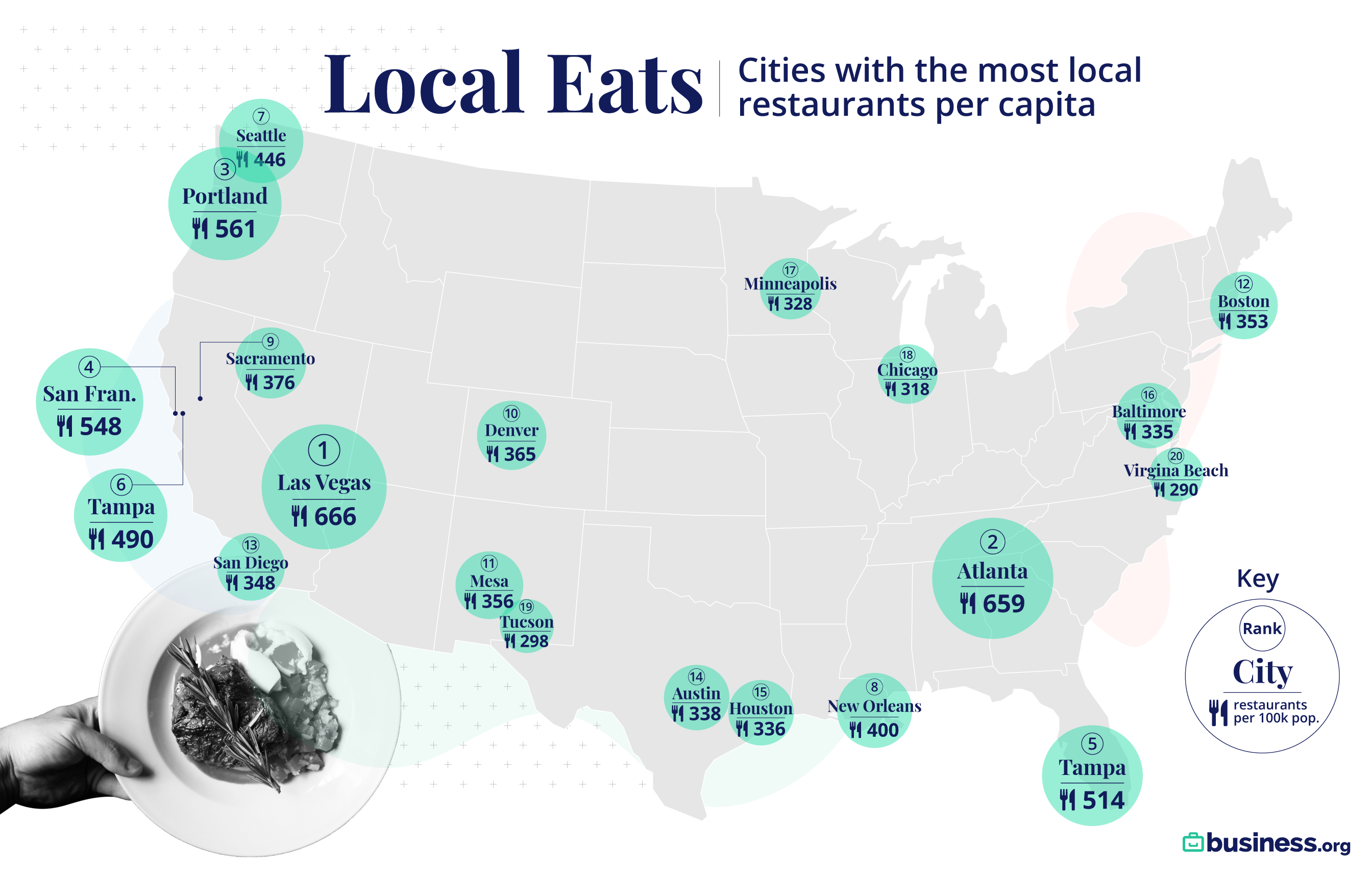

The Best Local Eats in the Most Food-Obsessed Cities

Do you miss your favorite coffee shop’s croissants? Or the thrill of life scoping out the new spots in town and finding those perfect little holes in the wall?

With more small-business restaurants reopening, we wanted to highlight which cities are food havens—and the best place in town to find a meal. Restaurants have implemented sanitizing and social distancing measures, as well as using technology like Square to make your visit as clean and touch-free as can be.

Not every restaurant will be open for full service inside, so make sure to check the location’s website or call ahead before you put on your best pearls—you may opt for takeout on the couch in sweats instead.

Check out our rankings below to find your town, or to start dreaming about where you want to travel for your next foodcation.

Interesting Findings

- The City of Sin had a deliciously devilish 666 restaurants per 100K people, making it the big winner for our most food-obsessed city. In Las Vegas, odds are everyone can find food worth betting on.

- It’s no surprise that even though New Orleans has a lower population than others on the list, it had 400 restaurants for every 100K people, ensuring there’s plenty of good cajun cookin’ (and more) to go around.

- If you think New Yorkers have an “eat or get eaten” attitude, it’s because 8.3 million people have 10,910 restaurants to choose from. That’s far more places to eat than any other city, but for the Big Apple, it means there are only 131 restaurants per 100K people.

- Speaking of hungry mouths, both Phoenix and Miami have populations of over one million people but ranked low for their disproportionate lack of restaurants. We think one of the best ways to beat the heat is to have a cold drink and eat, so hopefully, these art-centric cities add a little more food to their selection.

Which restaurants in your hometown could use a boost to their business? Let us know in the comments below which spots you plan on visiting.

Methodology

We ranked the most food-obsessed cities by the number of restaurants per 100K residents. To get the info, we sourced population figures from the U.S. Census Bureau1, the number of restaurants in each city from Trip Advisor2, and the most “recommended” restaurant within 20 miles of each city’s center from Yelp3.

Sources: