💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

What Is a Sales Invoice?

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Sales invoices are handy documents that tell your clients what they bought from you, when they placed their order, and how much they owe you. Sales invoices also help business owners track profits—and ensure they're paying the IRS the right amount come tax season.

Most types of businesses use sales invoices, so whether you sell products (like handbags) or services (like wedding planning), sales invoices are among the main ways to make sure you get paid. Let's dive into them below.

What are sales invoices used for?

A sales invoice's main purpose is to bill clients correctly and ensure you get paid on time. But sales invoices aren't just for your customers: they're also the primary way most businesses record profits.

Whenever you issue an invoice, you'll want to save a copy for your own financial records. Typically, once invoices are issued, you'll record them as accounts receivable, one of your asset accounts in your general ledger. (Not sure what that means? Hop over to our explanation of the most important financial documents for business owners.)

Sales invoices help you in a few other ways too:

- They help you pay the right amount in taxes by providing an accurate record of your business's income.

- They help you decide how much inventory to keep in stock by detailing how many goods you've shipped and what you need to replenish.

- They protect you in case of an IRS audit or customer complaints about services rendered. (It always pays to have physical evidence in your corner if either the IRS or a disgruntled client comes calling.)

By signing up I agree to the Terms of Use and Privacy Policy.

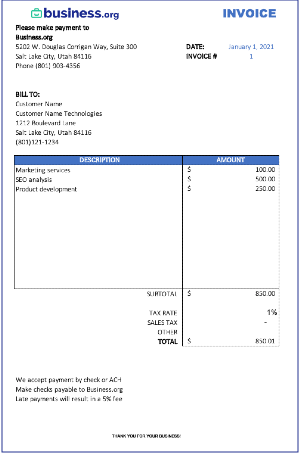

What information is on a sales invoice?

Most sales invoices list the following pieces of information:

- Your business's name and contact information

- Your customer's name and contact information

- Date of the business transaction and invoice issuance date

- Description of service rendered or product sold

- Total amount owed

- Payment deadline

Your business's name and contact information go across the top of the invoice. If you use invoicing software, you can customize the header with your business's logo and colors.

The description section of the invoice might be super short ("one-hour consultation") or, if you worked with a customer on a lengthy project or sold them several bulk orders, quite long. Either way, each item sold needs its own line and description on the invoice.

Finally, each sales invoice should have a unique invoice number that helps both you and your client (but mostly you) keep track of how many invoices you've issued.

How do you create a sales invoice?

Most accounting software includes an invoicing feature, so if you already use an accounting solution like QuickBooks Online or Xero, you can just launch the software, find the invoice feature, and get to work. Accounting software typically includes payment gateways too, which means you can accept customers' invoice payments online. Depending on your software, customers can even use payment portals on the invoice itself to make a payment.

If you've just started a freelance gig and aren't quite ready to commit to accounting software, you can download an Office 365, Google Docs, or FreshBooks sales invoice template instead. All three templates are easy to customize and print or email, but they come with zero bells and whistles: you can't accept payments through the invoice or send customer reminders.

Need a little less than full-fledged accounting software but more than a simple invoice template? Wave and Zoho Books both offer free invoicing-only software. (Wave's free invoicing app also lets you send invoices and accept payments on the go.)

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike.

- Track time and expenses

- Create custom invoices

- Accept online payments

Sales invoice FAQ

Is a sales order the same as a sales invoice?

No. A sales invoice is a record of a financial transaction created by the business owner and delivered to the customer. A sales order is the opposite: it's created by a customer who has placed and paid for an order. Sales orders are typically prepaid by the customer while sales invoices notify customers of payments due. In other words, a sales order shows what a business owes a customer, and a sales invoice shows what a customer owes a business.

How do purchase orders differ from sales invoices?

A purchase order (PO) is a document created by a customer and sent to the seller to confirm a pending purchase. Purchase orders include information about which product a customer is ordering, how much of that product they're ordering, when they need the order by, and when they'll pay for the purchase.

The PO should also include any relevant terms and conditions, which vary from company to company. For instance, depending on your company, you might note that the seller isn't responsible for damage that occurs during transit, or that the buyer won't pay for goods that get lost in the mail.

POs are important to inventory management: when customers place purchase orders, you can keep enough inventory in stock to fill their needs without overstocking.

In contrast, sales invoices record a transaction that has already been made—the seller has already sold the product or performed the service, and all that remains is for the buyer to finalize their payment.

Is an invoice the same as a receipt?

No. While an invoice is a request for a customer to pay for a product or service they've already received, a receipt is a confirmation that the customer already made the purchase. Both sales receipts and sales invoices are important documents for business owners to hang on to—they'll help you track your profits and business expenses, not to mention file your taxes correctly at the end of the year.

What is a pro forma invoice?

Unlike a typical sales invoice, a pro forma (or proforma) invoice is created by the seller before they perform any services or sell any goods. They're similar to a quote, proposal, or estimate, and they help you and your customer align your expectations before you get into the actual business transaction.

The takeaway

You work hard to make your clients happy—and a sales invoice helps ensure you're fairly paid for that work. When you ship a beautiful custom quilt to a customer or finish arranging the perfect centerpieces, make sure to send an invoice as well, and then to follow up on payments if customers don't.

Want more tools for getting paid on time? Our list of the best billing and invoicing software for small businesses is a great place to start.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.