💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

Chase vs. Bank of America: Business Banking Compared

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Chase and Bank of America are the two biggest banks in the United States, with thousands of branches spread across dozens of states.1 So when you’re trying to choose a bank, there’s a good chance these two banks are at the top of your list.

But which of the two should you actually do your business banking with?

We’ll help you decide. In this article, we’ll tell you about standout features from each bank, break down their account options, and give you all the details you need to decide whether Chase or Bank of America is the best big bank for your business.

Bank of America: Best banking rewards program

Bank of America (BofA) rewards you for using its business banking, thanks to its Preferred Rewards for Business program. It’s one of the best rewards programs we’ve seen from a bank.

The Preferred Rewards program gets you things like discounts on banking fees, rewards bonuses on credit cards, higher interest rates on savings accounts, and discounted interest rates on loans.

And the more business you do with BofA, the more you get rewarded. The Preferred Rewards program has three tiers (Gold, Platinum, and Platinum Honors), with each tier getting you better rates and bigger discounts. (Our Bank of America review has all the details.)

Just keep in mind that you need a fair bit of cash to get started with Bank of America’s rewards program. Even the Gold tier requires you have an average balance of $20,000 in BofA business deposit or investment accounts. And the Platinum and Platinum Honors tiers require $50,000 and $100,000 average balances, respectively.

But if your business has the money to qualify, Bank of America Preferred Rewards can get you great banking deals.

By signing up I agree to the Terms of Use and Privacy Policy.

Chase: Best for bank account choices

Are you the kind of person that likes to have as many options as you can? Then you’ll like all the bank accounts Chase offers.

While Bank of America recently consolidated its business account offerings, Chase continues to offer quite a variety of business checking accounts―from an affordable basic account to premium checking to analyzed checking. Plus, Chase offers interest-bearing versions of some of its accounts.

Chase also offers more savings account options than Bank of America. In other words, Chase gives you enough choices that you can pick a bank account (or two) that fits your business just right.

That said, we can’t talk about Chase without mentioning the elephant in the bank: its really bad reputation. Chase has had a lot of scandals in recent years, including things like discriminating against borrowers and overcharging its customers. You can read more about Chase’s sketchy past in our Chase review―but our point is that we can’t really recommend Chase based on its bad habits.

Still, if you’re willing to look past Chase’s colorful history, its variety of business bank accounts gives you plenty of options for getting the banking experience you want.

Availability

Now that we’ve talked about the standout features of each bank, let’s dig deep into how Chase and Bank of America compare.

To begin with, we need to talk about availability.

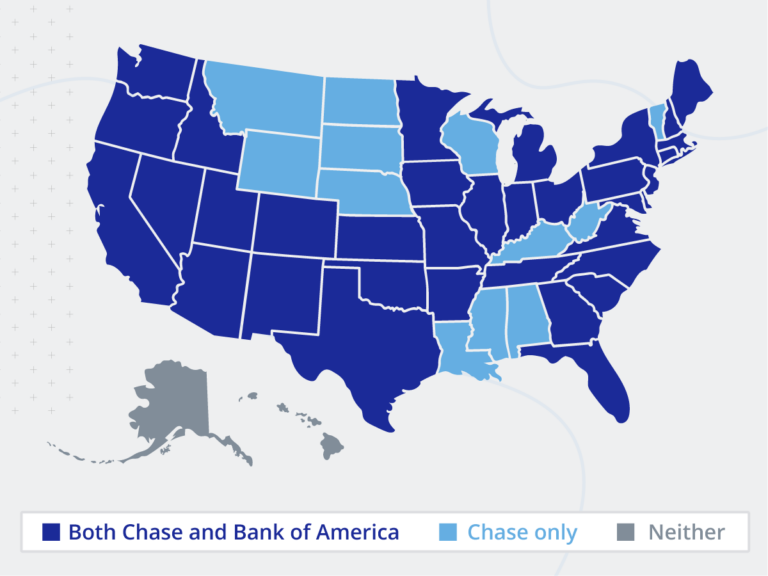

Both banks are in most states―but not all.

As you can see in the map above, Chase is more widely available, with branches in 12 states Bank of America doesn’t operate in: Alabama, Kentucky, Louisiana, Mississippi, Montana, Nebraska, North Dakota, South Dakota, Vermont, West Virginia, Wisconsin, Wyoming.

Chase expanded its footprint in 2021 and is the first bank to have branches in all lower 48 states, adding 10 new states in July and August of 2021. Since 2018, it added 25 new states to its list of retail branches.

So depending on where your business is, your decision to bank with Chase or Bank of America may be made for you. (And if neither bank is available in your area, we can direct you to the best bank for business in your state.)

Assuming that both banks do business in your state, you’ll have to use other factors to make your choice between the two―like the specific bank accounts they offer.

Deposit accounts

At both Chase and Bank of America, you can get business checking and savings accounts. Time to compare those account offerings.

While Bank of America and Chase have lots of brick-and-mortar branches, they both let you apply for business bank accounts online. And once you have an account, they both offer online and mobile banking.

Checking accounts

Chase and BofA both offer several tiers of business checking accounts (though, like we said earlier, Chase offers more).

To start with, let’s see how their cheapest, most basic checking accounts stack up.

Chase vs. Bank of America basic business checking accounts

Data as of 07/01/22. Offers and availability may vary by location and are subject to change.

As you can see in the table above, the two accounts have a pretty comparable monthly maintenance fee. They’ve also got similar ATM fees, transaction fees, and overdraft fees.

But Bank of America’s basic checking account comes with more free transactions and free cash deposits than Chase’s basic checking does. Plus, Bank of America charges way less for additional account transactions than Chase does.

Another difference? How they let you waive the monthly fee. Bank of America give you three ways to waive the monthly maintenance fee on its basic checking account:

- Keeping a $5,000 combined average balance (in this account and linked business accounts)

- Making $250 in debit card purchases from this account

- Enrolling in Preferred Rewards for Business

To waive the monthly fee on its basic checking account, Chase gives you four options:

- Keeping a $2,000 minimum account balance

- Spending $2,000 on a Chase Ink Business credit card

- Making $2,000 in deposits from Chase Quick Accept or Chase merchant services

- Having a military ID

So which ends up being easier to waive? It depends on your habits. Chase makes it easier to waive the monthly fee based on your account balance, while Bank of America makes it easier to waive the fee based on your spending.

But those are just the most basic banks accounts Chase and Bank of America offer. You’ve got way more choices than just those two, as you can see in the table below.

Chase vs. Bank of America business checking accounts

Data as of 07/01/22. Offers and availability may vary by location and are subject to change.

Two accounts worth pointing out are Chase’s Platinum Business Checking and Bank of America’s Business Advantage Relationship Banking. Both accounts give you 500 transactions and around $20,000 in free cash deposits (though Chase gives you $5,000 more free). Pretty comparable, right? But Bank of America charges a much lower monthly fee―about one-third of the cost of Chase’s account.

As we said before, though, Chase simply gives you more options. So while Bank of America may be more affordable for some accounts, Chase can help you get a niche account that better meets your business’s needs.

Savings accounts

In addition to business checking accounts, both banks also offer business savings accounts.

Chase vs. BofA small-business savings accounts

Data as of 07/01/22. Offers and availability may vary by location and are subject to change.

Unfortunately, you shouldn’t expect to earn much interest from these savings accounts. Both Chase and Bank of America offer disappointingly low interest rates and APY (annual percentage yield) on their business savings accounts.

(If you want better interest rates, we suggest looking at Small Business Bank. It’s an online bank that offers the most competitive APY we’ve found for business savings.)

Interest rates aside, the biggest difference between savings at the two banks is simply that Chase offers two savings account options, while Bank of America has just one. So again, Chase gives you more account options.

But standard savings accounts aren’t your only option. Both banks also have certificates of deposit (CDs) available as well.

Chase vs. BofA small-business CDs

Data as of 07/01/22. Offers and availability may vary by location and are subject to change.

As with the standard savings accounts, Chase and Bank of America have pretty comparable (if disappointing) interest rates on their business CDs. Do note, though, that you need to enroll in Bank of America’s Preferred Rewards program to get its best rates, while Chase’s rates just depend on your term and deposit amount.

Likewise, both banks offer comparable term lengths. (Remember, you can’t touch the money in your CD until your term is up.)

And that covers Chase and Bank of America business accounts. But banking aside, both banks offer other business products and services you might want to know about.

Chase vs. Bank of America business loans

Data as of 07/01/22. Offers and availability may vary by location and are subject to change.

Their loan offerings look pretty similar, except Bank of America offers special medical practice financing (for dentists, optometrists, physicians, and veterinarians).

To qualify for a Bank of America business loan, your business needs to be at least two years old and earn $100,000 in annual revenue. Some of its loans have stricter borrower requirements, though, with a minimum $250,000 in annual revenue. And while Bank of America doesn’t list a specific credit requirement, we expect you need a personal credit score in the high 600s at least.

Chase, on the other hand, doesn’t list any borrower requirements―but that doesn’t mean it doesn’t have any. We expect its requirements to look similar to Bank of America’s: a business that’s at least a couple years old and earns more than $100,000 in revenue―plus a solid credit score.

If you’d like a full breakdown of each bank’s loan products, you can check out our Chase business loan review and our Bank of America loan review.

Credit cards

Chase and Bank of America also have business credit card options.

As you might have already guessed, Chase offers more choices. It has nine business credit cards you can choose from, while Bank of America has six.

Most of Chase’s business credit cards are Visas (there is one MasterCard), with options for cash back, points-based, or travel rewards. Bank of America, though, is mostly Mastercard with one Visa option, again with cash back, points-based, and travel reward offerings.

Both banks have at least a couple cards that don’t charge any annual fee. Likewise, both Bank of America and Chase offer a 0% introductory APR (annual percentage rate) on some of their cards.

Miscellaneous

Finally, both banks offer a few more business services:

- Merchant services

- Remote deposit

- 401(k) retirement accounts

In addition, Bank of America has health savings accounts (HSAs) and payroll services.

And of course, both banks have a full suite of personal banking products, including checking accounts, savings accounts, credit cards, loans, and more.

Customer reviews

As we’ve shown you, both Chase and Bank of America have lots of banking options, with plenty of accounts and other products.

But what do people who have actually used all those accounts and products―their customers―think of these banks?

Well, the news isn’t great. Both Bank of America and Chase have pretty low customer reviews. Bank of America earns a 2.5 out of 5 on Bank Branch Locator and 1.3 out of 5 on Trustpilot. Chase does better on Bank Branch Locator, with a 3.0, and slightly better on Trustpilot, with a 1.4 score.2, 3, 4, 5

Many of the negative reviews for both banks are about customer service, with customers complaining they couldn’t get the help they need. Bank of America has more complaints about its website and app, with some people saying they’re too broken for regular mobile banking. Chase, on the other hand, gets complaints about failing to honor offers (like bonuses for opening a new checking account) and mishandling fraud.

And as for the good stuff, both banks also got nice reviews about their mobile apps and customer service―you know, the same thing some people complained about.

On the whole, we find the Chase-specific complaints a little more concerning―especially given its scandalous history. But at either bank, don’t expect top-notch customer service or a perfect mobile banking experience.

The takeaway

So which financial institution should your business go with―Chase or Bank of America? If you want to maximize your account options, you’ll probably prefer Chase. It offers more checking and savings account choices than Bank of America does. But if you’d rather get rewarded for your banking activities, Bank of America and its Preferred Rewards is the way to go.

Either way, you’ll be dealing with a big bank that has lots of accounts, loans, and other services for your business. On the other hand, you’ll also be doing business with a bank that has less-than-ideal customer reviews.

Of course, the choice is ultimately yours―but we hope we’ve helped you find the bank that better fits your business.

Not convinced by either Bank of America or Chase? Find an alternative option (with a better reputation) on our list of the best online banks for business.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

1. Business Insider, “Here Is a List of the Largest Banks in the United States by Assets in 2022.” January 2, 2022. Accessed July 1, 2022.

2. Bank Branch Locator, “Bank of America.” Accessed July 1, 2022.

3. Trustpilot, “Bank of America.” Accessed July 1, 2022.

4. Bank Branch Locator, “Chase Bank.” Accessed July 1, 2022.

5. Trustpilot, “Chase.” Accessed July 1, 2022.