💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

The 7 Best Small Business Loans for Minorities in 2023

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Statistically speaking, you’ll have a harder time getting a small-business loan if you’re a minority business owner. People debate the reasons for that disparity, but the point remains: getting financing for your business may end up being more challenging than it should be.

We hope to see those stats change in the future. But for now, one of the best ways you can increase your chances of getting successfully funded is to simply apply with the right lenders.

In this article, we’ll review the best business loans for minorities. We’ll also answer some common questions about minority business loans and take a look at some other financing options.

We want to be clear: there are no business loans just for minority business owners. The lenders below are open to all business owners―but they may work better for minorities than other lenders would. Our FAQ below explains more.

Lendio: Best overall for minority-owned businesses

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Lendio tops our list of the best business loans for minorities for one simple reason: one application to Lendio gives you access to many different loan options from many different lenders.

And we do mean many. Lendio can get you a commercial real estate loan from a traditional lender. It can also get you a term loan from an online lender. Or invoice financing from an accounts receivable company. Or a business line of credit from―well, you get the point.

(In fact, the table below includes just a few of Lendio’s loan options. You can see the full list in our Lendio review.)

Lendio loan details

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

That’s because Lendio works as a lending marketplace, matching borrowers (you, in this case) with lenders based on your loan application. A dedicated loan specialist will help you find the perfect loan, taking into account your personal credit score, your business model, your ability to repay the loan, and all sorts of other factors.

So no matter your situation, you can probably find a loan for your business. You can even compare loan offers to make sure you get the best one.

As an added bonus, Lendio can even hook you up with some of the other lenders on this list. It might take longer than talking to those lenders directly, though, since you’ll have to wait a day or two for Lendio to match you with loans.

Put simply, Lendio has plenty of loans (and lenders) for plenty of borrower situations―and that’s why it tops our list of the best business loans for minority small-business owners.

Bluevine: Best for larger cash-flow loans

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Bluevine offers an excellent balance between accessible borrower requirements and large, flexible financing.

You can get a line of credit or invoice factoring from Bluevine. While the specific borrower requirements vary a bit from product to product, both types of Bluevine financing come with pretty reasonable requirements. For example, its line of credit requires a 625 credit score and six months in business, while its invoice factoring lets you apply with a 530 credit score and three months in business.

Bluevine loan details

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Those aren’t quite the lowest requirements we’ve seen (Fundbox, notably, has lower), but they come with larger maximum loan sizes than you’d get from other cash flow lenders.

In fact, Bluevine offers invoice factoring up to $5 million. Most cash flow lenders tap out somewhere between $100,000 and $250,000.

So if you want the accessibility of a cash flow loan with the flexibility more money brings, Bluevine might strike the right balance for you.

Fundbox: Best for young businesses

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Fundbox offers a business line of credit (LOC). But unlike credit lines from traditional lenders (like banks and credit unions), Fundbox’s LOC has pretty relaxed borrower requirements.

Businesses as young as three months old can apply for Fundbox financing. For context, most lenders require at least six months, with a year or more being standard. In addition, you can qualify for a Fundbox loan with just a 600 personal credit score―one of the lowest credit requirements out there.

That means that even young business owners can take advantage of Fundbox’s loan offerings, making it a good business loan for startups.

Fundbox loan details

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Plus, Fundbox uses an automated approval process. Just connect Fundbox to your business’s bank account, and let Fundbox do a soft credit pull.

After that, you can get an answer to your application in mere minutes.

Of course, Fundbox has some drawbacks you need to know. It has pretty short repayment terms and relatively high fees. In other words, it’s not the cheapest option out there.

Even so, Fundbox’s low borrower requirements make it a good option for business owners that can’t yet qualify for other loans.

Kabbage: Most convenient

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Kabbage offers a business line of credit (LOC) through American Express. And like Fundbox, Kabbage also uses an automated application process. You connect Kabbage with your business checking account or accounting software, and it looks at your financials. The proprietary algorithm makes a decision within minutes.

But that’s not the only thing that sets Kabbage apart; it also has some of the fastest funding times we’ve seen. You can choose to get funds in one of three ways: a Kabbage card (it takes a few days for you to get in the mail), direct deposit into your bank account (within one to three days), or deposit into your PayPal account (within minutes).

Kabbage loan details

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

The catch comes with Kabbage’s high rates. You’ll pay substantial fees as you repay the loan, and the repayment structure—which front-loads your fees—is best described as “pretty confusing.” Still, the fast access to funds, even without perfect personal credit, might make the fees worth it.

Accion Opportunity Fund: Best for smaller loans

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Accion’s entire mission is to get loans in the hands (and bank accounts) of underserved communities and people who get turned away by traditional lenders. Accion emphasizes that it wants to get to know your business’s unique story and strengths as part of its decision-making process.

While it doesn’t publish exact qualifications, Accion reportedly has much more flexible application requirements than most lenders. It looks at your credit score, sure, but that’s just one of many factors.

Accion loan details

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

And rather than deny you a term loan outright, Accion seems willing to offer you a smaller loan, like a $1,000 microloan, so you get at least a little funding. Even if you get turned down, Accion will offer guidance on how you can get accepted in the future.

Unlike most of the lenders on this list though, Accion has a relatively lengthy and involved application. If you need fast funds, look elsewhere. And while Accion does extend large loans, those large loans seem to be few and far between. Accion’s loans start at $5,000, and its average loan size is just under $15,000.

By signing up I agree to the Terms of Use.

Honorable mentions

Kiva: Best for microloans

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Unlike the other lenders featured here, Kiva offers only microloans―small term loans under $15,000, in this case.

That might not seem like a lot of money, but Kiva has another big advantage that makes it worth looking at: It doesn’t charge interest on those microloans. At all.

Now, Kiva uses an unconventional crowdfunding process for its loans. You’ll have 30 days to get people to contribute to your loan fund. That means that you don’t have to meet any particular borrower requirements, but it also means that Kiva has a very slow funding turnaround time.

All the same, if you can deal with a smaller loan and slow funding, Kiva’s accessible microloans might be the cheapest funding you can get.

Wells Fargo: Best big-bank option

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Wells Fargo offers much of what you want from traditional financing: lots of loan choices, all with long terms and low rates.

Unfortunately, that comes with (very) strict borrower criteria. Still, we included Wells Fargo on this list because its rates and repayment terms are just that good.

Plus, Wells Fargo has shown a marked determination to improve lending to minority small businesses. In recent years, this large bank has performed studies on the state of minority small-business financing and then used those results to create programs supporting minority entrepreneurs.

So if you’re a minority business owner looking for financing from a traditional financial institution, Wells Fargo should probably be your first stop.

But as we said, Wells Fargo has the strictest application requirements of any lender on this list: two years in business and $1.50 of revenue for each $1 you borrow. If you can meet that criteria, however, you can get some great deals.

Other funding options for minorities

If you think funding begins and ends with term loans and microloans, think again. Minority business owners have other financing options.

Grants

Grants give your business free money. You don’t have to repay them, and most business grant applications won’t ask for things like credit history or annual revenue, making them a highly desirable option.

Many business grants for minorities exist. For example, the Asian Women Giving Circle gives up to $15,000 to businesses led by Asian American women, and the First Nations Development Institute gives grants to Native nonprofits.

To get a minority business grant, you’ll have to find one you qualify for and then apply. Most grants have lots of applications (everyone wants free money, after all), so don’t expect to be a shoo-in for a grant just because you meet the basic qualifications.

You may have more success looking for local grants. Various organizations in your community might sponsor grants for minority business owners, and you’ll likely have less competition.

Angel investors

Angel investors, well, invest in your business. Usually, they do this in exchange for equity in the business. So you don’t have to repay a loan, but you will have to give up some business profits. Many entrepreneurs find this to be a reasonable trade-off.

While minority small-business owners get rejected for loans at much higher rates than non-minority small-business owners, that gap largely disappears when it comes to getting angel investors.

About 17% of entrepreneurs trying to get funding from angel investors get it; for minority entrepreneurs specifically, 16.1% get the angel investor funding they seek.4 So minority business owners would do well to look at angel investors.

Our research shows that some prominent minority-focused angel investment groups have come and gone, so you should do some searching to find out who’s currently active in the angel investing scene. But here’s a list of black angel investors to get you started.

Non-financing opportunities

Securing working capital is key to business development, but it isn’t the only way to boost your business. These opportunities won’t directly get you a loan, but they will help you succeed as an entrepreneur.

The SBA has a variety of programs for small businesses, but the SBA 8(a) program specifically awards government contracts to “disadvantaged” small businesses. In this case, that means economically or socially disadvantaged businesses—such as those that have felt the effects of racial discrimination.

Also, many states and cities have local networking groups, often for minorities or specific races and ethnicities. BlackConnect, Latinx Detroit, and Asian American Chamber of Commerce are just a few examples of these small-business networking groups. These groups can provide resources, mentoring, and other business development help.

Enter your loan needs and qualifications to get matched with a list of lenders best suited to you. Then, sort by the financing factor that you find most important. (Note: not all lenders allow personal loans for business use.)

The takeaway

You won’t find any business loan specifically for minority business owners―but there are some lenders that may be better suited to funding minority-owned businesses, thanks to automated applications, relaxed borrower requirements, and programs designed to support minority entrepreneurs:

- Lendio gives business owners access to the highest volume of quality lenders

- Bluevine is perfect for finding larger loans

- Fundbox has options for young business owners

- Kabbage offers a convenient alternative with their automated loan application

- Accion Opportunity Fund connects businesses with smaller-sized loans

We know a list like this won’t solve inequality in lending. The business funding world still has a long way to go. But we hope that it helps you get the working capital you need to build your minority-owned business.

Want to make sure you have the strongest possible loan application? Check out our guide to common mistakes when getting a business loan to make sure you’re prepared.

Methodology

We researched more than 50 lenders to find which ones offered the most competitive loans for minority business owners. We examined special offerings for minority groups in addition to analyzing ease of use.

Minority business loan FAQ

We’ve shown you the best loans for minority businesses, but let’s take some time to answer some common questions.

Believe it or not (you’ll probably believe it), there’s actually a lively debate around this question. A brief from the U.S. Small Business Administration (SBA) Office of Advocacy suggests that minority entrepreneurs get rejected at higher rates because they tend to

- have lower credit scores,

- be less likely to have a house to use as collateral,

- want to fund businesses in less desirable locations,

- operate in less profitable industries, and

- have less “social capital” to help their businesses.

Significantly, the Minority Business Development Agency (MBDA) adds an additional reason to its own list.3 According to the MBDA, minority business owners also

- experience racial discrimination from lenders.

And at least one study backs that up. Researchers sent nine businessmen to various traditional banks in search of a $60,000 small-business loan. Each man was dressed identically, had similar body types, and possessed similar educational and financial backgrounds. The only difference? Three of the men were white, three were black, and three were Hispanic.

You can guess what happened. The black and Hispanic businessmen received less information about loans and less help with the application process. They were even less likely to get offered a business card. Instead, they got more questions about their personal financial situations.

So when a minority business owner gets denied funding, it could be because of legitimate reasons or plain old racism. Either way, the high rejection rates for minority small-business owners usually leads to our next question.

No, there’s no such thing as a business loan exclusively for minority business owners. Lenders can’t discriminate on the basis of a borrower’s race. So while that means they can’t reject you because of your race, they also can’t approve you or give you special terms because of your race.

Note that you might see minority-specific loan programs. These generally help minority business owners strengthen their applications for loans or guide them through the loan process. They are not loans themselves.

Then why did you write this article?

While minority-specific loans don’t exist, we think these loans can work well for minority business owners who worry about getting rejected for traditional financing, whether that’s because of their credit history or because of discrimination.

For example, most lenders on this list don’t disqualify borrowers if they have lower-than-average credit scores. So if the SBA has it right, and minority borrowers get rejected because they may have lower credit scores, Fundbox or Kabbage might be a good choice.

Likewise, most of these lenders also won’t ask for specific collateral from borrowers, so lack of home ownership shouldn’t prove problematic.

Several lenders we featured, including Bluevine, Kabbage and, Fundbox, have automated applications. If the MBDA’s theory about racism proves correct, an automated approval process can help overcome the biases of a human loan officer or underwriter.

Likewise, Wells Fargo has taken steps to address racial bias in lending, meaning it might be a better choice than other traditional banks. Similarly, Accion emphasizes lending to minorities and other disadvantaged groups, and its microloans have looser lending requirements than many traditional lenders.

The point is, the loans on our list may not be minority-specific, but they can help address some of the reasons minority business lenders get rejected for financing.

Why do you keep saying “minority?”

We’re aware that not everyone loves “minority” as a label. To be frank, we’ve used this term for two reasons:

Various government agencies, like the MBDA and the SBA, use “minority” in their reports, program names, and resources. Most lenders and investors have followed suit.

As a result, “minority business owners” gets a lot more search volume than similar terms. We want to make sure people who need this article can find it, so we’ve stuck to the term.

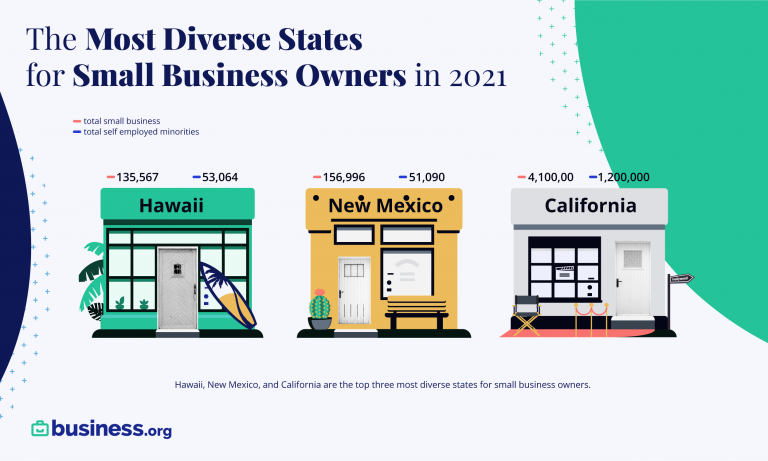

The Most Diverse States for Small-Business Owners

Wondering which states have the most minority-owned small businesses—including your own state? Business.org broke down the percentage of businesses owned by members of US minority groups in each state. Learn how diverse your state’s small-business economy is on our chart below.

Methodology

To determine which states have the most minority business owners, we looked at the Small Business Association’s (SBA’s) 2020 small-business profiles. These state profiles list the number of minority-owned businesses in each state along with the total number of each state’s small businesses. Using the SBA’s data, we determined which percentage of each state’s small businesses are owned by self-employed members of minority groups.

Key findings

- The largest states in the nation have some of the highest percentages of minority-owned firms. For instance, 29.3% of California’s small businesses are minority owned, as are 25.4% of Texas’s small businesses. In Alaska, the biggest state by acreage, 14.2% of small businesses are minority owned—lower than both Texas and California, but still above the national mean.

- Hawaii has the highest percentage of minority-owned small businesses in the nation (39.1%), which makes sense: Hawaii is also one of the country’s most diverse states.4

- The country’s most diverse states aren’t confined to just one region. States on both coasts make it into the top ten (like California and Maryland), as do states in the West (New Mexico, Nevada) and South (Florida, Georgia).

State-by-state minority-owned business comparison

The takeaway

Minority-owned businesses are an essential part of the nation’s economy, and nothing brought that point home as clearly as the COVID-19 crisis. So no matter where your state falls on our list of the most and least diverse states for small businesses, we encourage you to actively find and support minority-owned small businesses in your area. Doing so benefits local individuals and businesses, sure, but it also supports the local, state, and national economy—and every boost matters in this post-pandemic world.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

1. MBDA, “Executive Summary - Disparities in Capital Access between Minority and Non-Minority Businesses” Accessed November 9, 2022.

2. SBA, “Access to Capital for Women- and Minority-owned Businesses: Revisiting Key Variables” Accessed November 9, 2022.

3. MDBA, “Minority Business Owners - Continual Success with Angel Investors!” Accessed November 9, 2022.

4. US Census Bureau, Research and Economic Division, “Hawaii Population Characteristics 2019.” Accessed November 9, 2022.