💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

BBVA Bank Business Banking Review | Business.org

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

BBVA's United States operations were sold to PNC Financial Services in June 2021. BBVA still offers some banking and investment services in the US, but only for large corporations and institutional investors. As a result, this page is for historical reference only.

If you’re in the Southwest (or Florida or Alabama), you’ve probably heard about BBVA (formerly BBVA Compass). It’s not the biggest traditional bank out there, but BBVA has got quite a few accounts and services for businesses. Is it any good though?

We’re here to help you answer that question. We’ll tell you what kinds of businesses we think will like BBVA, break down all of BBVA’s business accounts and products, and analyze some BBVA Bank customer reviews.

BBVA is best for nonprofits (in a few states)

Most of BBVA’s accounts and other offerings seem pretty standard. It’s a fine bank if you happen to have one nearby, but it’s not the kind of bank you should drive across town to use―unless you have a nonprofit business.

BBVA has one of the best programs we’ve seen for nonprofits. You can get a bank account with no monthly fee (and quite a few perks), plus you can easily raise funds for your nonprofit. (We’ll explain the program in more detail below.)

BBVA fast facts

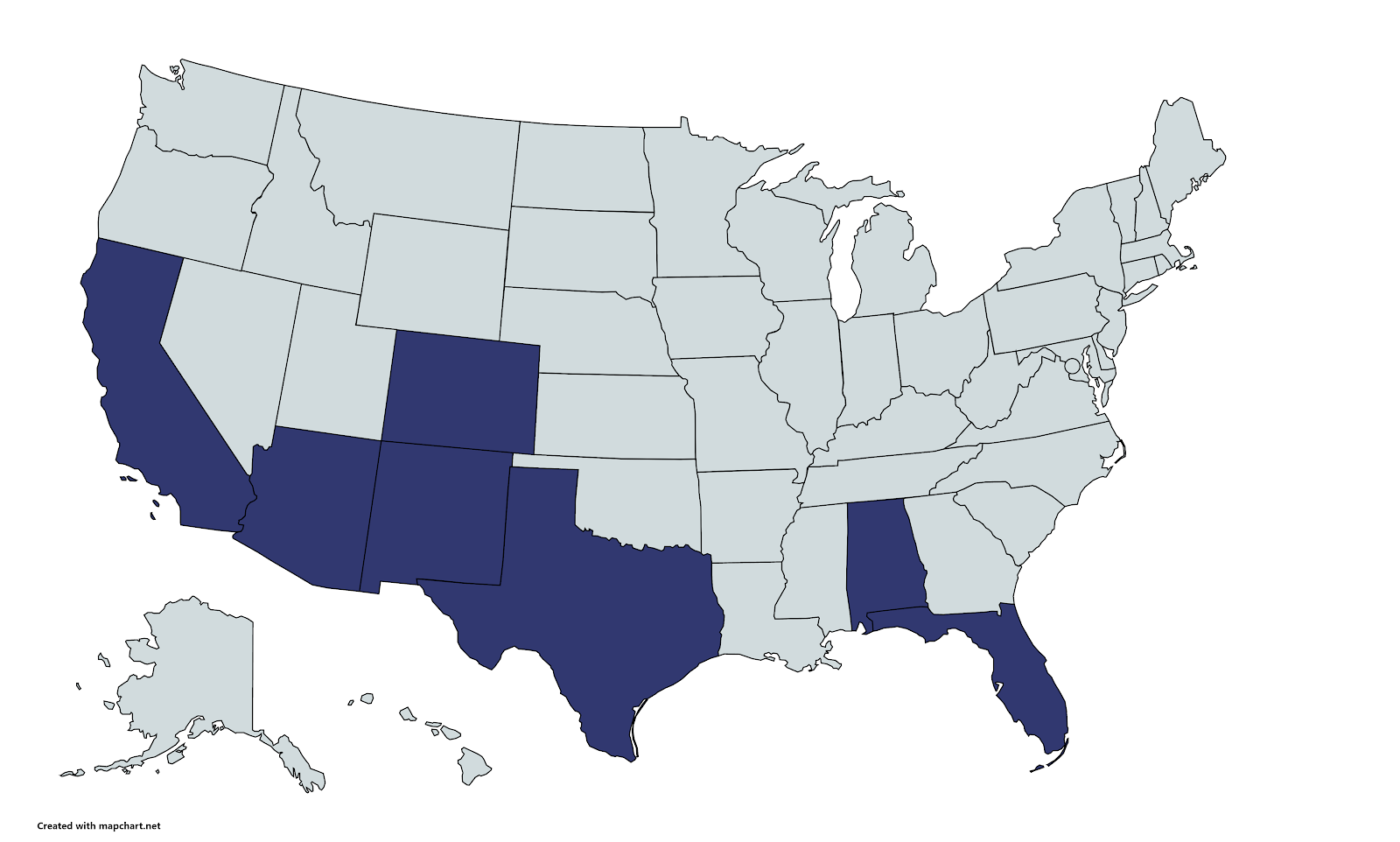

So if you’re a nonprofit in one of the seven states BBVA operates in (Alabama, Arizona, California, Colorado, Florida, New Mexico, and Texas), then we definitely recommend BBVA for you.

And if you’re not a nonprofit, but you’re still in those seven states, we’d say BBVA is a decent choice for your business banking. It may not be our favorite bank out there, but it offers a good choice of affordable accounts.

Map of BBVA availability

(And if you’re not in one of those seven states, we can help you find the best bank for business in your state.)

So to help you decide if BBVA will really work well for your business, let’s take a closer look at exactly what you can get from BBVA.

By signing up I agree to the Terms of Use.

BBVA checking and savings accounts

BBVA doesn’t offer quite as many accounts as some banks do, but you’ll still have quite a few options to choose from.

Checking accounts

BBVA gives you a choice of three business checking accounts.

Each account has a $100 minimum deposit, and they all come with at least one business debit card. All the other details are different though―so you’ll want to put some thought into which account will work best for your business.

BBVA small-business checking accounts

Data effective 9/4/20. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

If you want just a basic checking account, you’ll probably like BBVA Business Connect Checking. This account doesn’t charge any monthly maintenance fee, and it gives you an unlimited number of (most) transactions. (You only get five in-bank withdrawals and processed checks per month.) That makes it a very affordable account, as long as you keep your usage simple.

If you have more complex banking needs, you might prefer BBVA Business Choice Checking. It does have a monthly fee, but you waive it by keeping a $5,000 average balance, processing $5,000 in merchant services, or by enrolling in BBVA for Your Cause as a nonprofit.

So why pay more for your checking account? Well, your Business Choice Checking account comes with your choice of two “premium features.” You can choose from the following:

- More free transactions each month

- More free cash deposits each month

- Overdraft forgiveness

- A free wire each month

- Unlimited returned deposited items

- Discounted checks

Depending on how you use your business bank account, these features could end up saving you quite a bit of money. And if you need more than two features, you can pay $10 (a month) for each additional feature you want.

If you keep a big account balance, though, then check out BBVA Business Premium Checking. It has the highest maintenance fee. And while you can waive it, it requires some big bucks to do so: either a $25,000 average balance, $25,000 processed with BBVA merchant services, or a $50,000 balance across your BBVA accounts (both personal and business).

BBVA Business Premium Checking lets you earn interest on your account balance. So it’s worth getting if you keep a lot of money in your account. Plus you get more free transactions and cash deposits, and you also get some premium features included (a free wire transfer each month, unlimited returned deposited items, and discounted checks).

BBVA also offers a no-fee IOLTA. (If you don’t already know what an IOLTA is, you don’t need one.)

Savings accounts

You can also get a couple types of business savings accounts from BBVA. One account is a standard savings account, while the other is a money market account. (BBVA doesn’t have any certificates of deposit.)

BBVA doesn’t publish interest rates for either savings account. That’s not usually a great sign. After all, if a bank has an interest rate to brag about, it usually does. So don’t expect to earn tons of interest from your BBVA business savings account.

(If you want a killer interest rate on your business savings, we recommend Small Business Bank.)

BBVA small-business savings accounts

Data effective 9/4/20. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

BBVA Business Savings is your standard account option. It has a low monthly fee, and you can waive it altogether by keeping a $500 average daily balance or by setting up a recurring monthly transfer of $25 or more from your BBVA business checking account. Take note, though: You can’t use checks with this account.

BBVA Business Money Market lets you use checks, but it has a higher minimum opening deposit and monthly fee. (The exact monthly fee varies by state). You can waive your monthly maintenance fee if you keep a $4,000 balance in your money market account.

You can also add Small Business Money Market Sweep Service to your BBVA money market account. You’ll just have to choose a target account balance for your checking account (at least $50,000).

When your checking account has more money, the excess amount gets automatically swept into your money market account to earn interest. But if your checking balance drops below the target number, funds from your money market account will get swept back in. It’s an easy way to earn more interest without any effort on your part―assuming you keep a high account balance, of course.

BBVA for Your Cause

BBVA has a few more banking products and services that we’ll get to in just a minute. But first, let’s talk more about why we recommend BBVA for nonprofits.

If you have a nonprofit business, you can sign up for BBVA for Your Cause. It’s a low-effort way to raise money for your nonprofit.

You’ll simply invite people to sign up for a BBVA checking account. If they do, you get $50 right off the bat. After that, you’ll get 0.25% of their debit card purchase amounts. No, you probably won’t fund your entire nonprofit with the funds you raise. But those small amounts can add up. Sounds easier than active fundraising, right?

Plus, as we mentioned above, you can waive the monthly fee on a Business Choice Checking account when you’re enrolled in BBVA for Your Cause. So your nonprofit gets cheaper banking and free money. Not a bad deal.

Other small-business products and services from BBVA

We’ve shown you BBVA’s bank accounts (the real stars of the show), but let’s look briefly at everything else it can help your business with.

Small-business financing

If you need a business loan or line of credit, BBVA has your back. It has a few different options for your business funding needs.

Compare BBVA’s small-business lending

Data effective 9/4/20. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

Unfortunately, BBVA doesn’t offer lots of information about its financing―no interest rates, for example. But because it’s a traditional bank, we assume it has low, competitive rates (compared to online lenders, at least).

Of course, being a traditional financial institution means that BBVA also has relatively stiff application requirements. While we can’t say for sure, you’ll probably need a credit score in the high 600s, revenue over $200,000, and a business that’s at least two years old―typical application requirements for banks.

Small-business credit cards

You can also choose from a couple business credit cards.

The BBVA Visa Business Rewards Credit Card has no annual fee, making it a cheap option. The Secured Visa Business Credit Card has a $40 annual fee after the first year, and your credit limit is proportional to your savings account. (You usually get a secured card when you don’t have great credit.)

Both credit cards earn points that you can apply as account credit or use to get gift cards. You can also get employee cards with either card choice.

Miscellaneous

Finally, BBVA has a few more things your business might need:

- Merchant services

- Payroll services

- Treasury management software

BBVA customer reviews

Before we wrap up our BBVA bank review, let’s look at what customers have to say about BBVA.

BBVA has a 2.7 (out of 5) on Trustpilot and a 3.2 (out of 5) on Bank Branch Locator.1,2 Those might not sound like great scores, but keep in mind that most traditional banks have far lower ratings (below 2.5 or even 2 in many cases). So BBVA isn’t doing that badly. But the reviews tend to be either really good or really bad―not much in the middle.

On the good side, people say customer service is helpful, they like their local branch staff, and BBVA has a good website and mobile app.

On the bad side, customers complain about poor customer service, cite issues with local branch staff, and say BBVA overcharged on fees.

So what’s the takeaway from all that?

Well, as with most brick-and-mortar banks, your experience can really change from branch to branch. We recommend looking at reviews for your local branch. If reviews look decent, great! Go with BBVA. And if they don’t? Maybe check out the best online banks instead. They tend to have better reviews.

The takeaway

You can choose from a nice mix of bank accounts and other banking services at BBVA bank. If you have a nonprofit, you can also benefit from BBVA’s standout BBVA for Your Cause Program to raise money for your business―a program that makes BBVA our favorite bank for nonprofit businesses.

So though BBVA isn’t our top-rated bank, it still makes a fine solution for many business’s banking needs.

Not sold on BBVA yet? We’ve got plenty of other suggestions. Check out our ranking of the best banks for small businesses to see our top picks.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

- Trustpilot, “BBVA Compass.” Accessed September 4, 2020.

- Bank Branch Locator, “BBVA.” Accessed September 4, 2020.