💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

The 10 Best Nanny Payroll Services of 2023

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

The bottom line: SurePayroll automates every aspect of nanny payroll at an extremely reasonable price, which makes it our favorite payroll solution for household employers.

If SurePayroll isn't right for you, though, there’s also Gusto's fully featured plans, Savvy Nanny's supremely affordable solutions, Paychex for HR add-ons, and NannyPay for DIY-friendly household payroll.

- : Best overall

- : Most comprehensive

- : Best benefit add-ons

- : Best for 2+ employees

- : Best DIY software

SurePayroll: Best overall nanny payroll service

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

SurePayroll is hands-down the best choice for paying your nanny correctly and on time with minimal effort on your part. Its nanny payroll service is both comprehensive and fully automated: SurePayroll calculates, deducts, and files nanny taxes, then automatically pays your nanny via direct deposit. With SurePayroll’s auto-payroll feature, you don’t have to remember to pay your employee on time—the software does it automatically.

Since it handles taxes for you, SurePayroll also includes a tax filing guarantee. SurePayroll promises that the taxes it helps you calculate (or the taxes it files for you) are accurate. If they aren’t, SurePayroll deals with the IRS and pays all associated fines and fees.

Regardless of the plan you pick, you get these SurePayroll perks:

- New hire state reporting

- Automatic payroll payments and direct deposit

- Employer-facing mobile app (for paying nannies on the go)

- Solid US-based customer service support, including evenings and weekends

And if customer support is a must for you, SurePayroll is a great pick. You can reach its customer service team from 8 a.m. to 7 p.m. CT on weekdays, and 9 a.m. to 1 p.m. CT on Saturdays. If customer support isn't available when you encounter an issue, you can send a chat detailing your issue. Someone from the SurePayroll team will get back to you ASAP.

SurePayroll definitely has a few drawbacks. For one, it's a little pricier than competitors like Savvy Nanny and NannyPay. But if you’re looking for secure, hands-off nanny payroll processing that takes care of everything from calculating net pay to filing taxes, SurePayroll's simple automation absolutely will hit the spot.

Gusto: Most comprehensive

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

Along with payroll tax calculation and filing, Gusto offers a host of services for household employers who want a totally hands-off nanny payroll experience:

- Automatic state, local, and federal payroll tax filing

- Automatic W-2 and 1099 form filing

- Automatic new hire reporting

- Automatic payroll runs

- Automatic wage garnishment (not available in South Carolina)

- Support for multiple pay schedules

- Employee self-service portal

- Easy integration with accounting software like FreshBooks and Xero

- Easy integration with time-tracking software like QuickBooks Time and Homebase

Gusto offers three payroll plans: Simple, Plus or Premium. The Simple plan costs $40 per month with an additional $6 per employee. The Plus plan is $60 a month and $12 per employee. The Premium plan includes dedicated support, health insurance broker integration and employee surveys and insights. The pricing is determined by the needs of the business. You will have to contact the Gusto sales team for that information.

Since Gusto handles every aspect of household employment, it costs a little more than pay-per-month software like SurePayroll. You are getting payroll, benefits, and HR tools all in one place.

Each Gusto customer is also entitled to support from experts who know your situation inside and out. Of course, the level of support depends on which plan you're paying for. But on every level, these experts can answer any questions you have, including how to file taxes for your small business.

Overall, each plan is flexible without long-term contracts. In fact, you can switch and cancel your plan at any time with no financial penalty to yourself.

Paychex: Best benefits add-ons

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

Paychex offers everything you’d expect from a full-service nanny payroll provider, like calculating payroll taxes and paying your nanny automatically. But it stands out in one crucial way: unlike many nanny-specific payroll providers, Paychex's general online payroll system offers optional benefit add-ons. You can use Paychex to offer competitive benefits like the following:

- Employee health benefits (including medical, vision, and dental insurance plans)

- Workers comp

- 401(k) options

Bear in mind that since you’ll pay extra for these services, Paychex’s $39 a month is just a starting price—we couldn't pin down exactly how much Paychex charges for its nanny-specific services.

However, that higher price gets you a host of other perks too. For instance, Paychex offers the absolute best payroll app for employers. If you spend a lot of time away from home (and your computer), Paychex simplifies on-the-go payroll better than any other provider.

Paychex also has better customer service than many of its cheaper competitors. You can contact the US-based customer service team 24/7, and Paychex’s HR experts are always on hand to answer benefits-related questions.

By signing up I agree to the Terms of Use and Privacy Policy.

Savvy Nanny: Best for 2+ employees

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

If you're paying more than one household worker to watch your kids, Savvy Nanny Payroll Services should be at the top of your list. Its $50-a-month plan lets you pay two employees and doesn't charge you extra for each paycheck deposited: the flat rate you see is exactly what you get. And if you have more than two employees, Savvy Nanny has your back there too. Each additional employee costs $6 extra per month and $5 extra at the end of the year.

Savvy Nanny also keeps things affordable by charging a one-time year-end tax filing fee of just $50. Compare that to NannyChex’s $80 fee per quarter and $150 fee for year-end filing and you can see why Savvy Nanny's payroll service stands out. Subscribers can access live chat, phone, and email support six days a week.

For most users, Savvy Nanny’s services should be among the most affordable out there. Still, you’ll want to read through its list of potential fees, which can include fees for payroll reruns, insufficient funds charges, and document access after employee termination. Of course, most providers charge extra for these services, though, not just Savvy Nanny—so Savvy Nanny doesn’t necessarily charge more. Instead, it’s just more transparent about extra fees than most, which we find a point in its favor.

NannyPay: Best DIY software

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

NannyPay is a payroll software program that starts at just under $200 per year—an impossible price to beat, and one key reason NannyPay is one of the best nanny payroll services.

But if you’re wondering why it’s so cheap, well, NannyPay calculates taxes for you, but it can’t file them on your behalf. The same is true of employee paychecks. NannyPay will tell you how much to pay your employee, but it doesn’t include the same direct deposit features as SurePayroll, Paychex, and Nanny Chex.

While NannyPay is pretty basic, it takes care of a few payroll tasks beyond paycheck calculations. For instance, you can print checks and pay stubs, store and organize crucial tax documents, and print out pre-filled end-of-year tax forms.

Best nanny payroll software: Honorable mentions

- : Best benefit options runner-up

- : Most user-friendly

- : Best dedicated assistasnce

- : Best HR support

- : Cheapest calculator-only

If our top nanny payroll picks above don’t meet your needs, don’t worry. Here are four more of the year’s best payroll tax services for nanny employers (or employers of other household workers).

Compare top nanny payroll features: Runners-up

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

*Billed quarterly

ADP: Best benefit options runner-up

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

ADP is one of the more popular small-business payroll providers in the nation, and its standard small-business software also includes household employer features. Like Paychex, ADP automates everything about payroll—you don't have to worry about calculating taxes by hand or remitting them to the government. ADP also has a well-reviewed employee app, which your nanny can use to check tax information, clock in and out, and adjust direct deposit settings on the go.

But ADP's heftier features and robust software come at a price—and since ADP doesn't list any transparent pricing on its site, we're not sure exactly how high that price is. We do know that ADP charges an extra fee if you want to add workers compensation insurance and health benefits. As with Paychex, you'll have to pay your insurance premiums and an extra monthly amount to ADP for the integration.

Finally, while ADP's software has household payroll capabilities, it isn't a nanny-first provider. Its main focus is on other small-business owners, so its features might be a little too complicated (and its interface too technical) for parents with little to no payroll experience.

Poppins Payroll: Most user-friendly

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

If you were hoping at least one nanny payroll service provider locked down a Mary Poppins reference, Poppins Payroll is absolutely here for you. At $45 a month, Poppins Payroll will take on just about every payroll task you need, from Employer Identification Number registration to new-hire paperwork filing. The service files taxes for you, stores records, and even helps with bookkeeping. Most notably, it doesn't charge extra for quarterly or year-end tax filing.

Unfortunately, for now Poppins Payroll is available in only 14 states and the District of Columbia. Poppins Payroll is planning to expand nationwide, though—hopefully, the other states will benefit from its stellar service, adorable website, and super low cost sooner rather than later.

HomeWork Solutions: Best dedicated assistance

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

HomeWork Solutions’ full-service plan includes a dedicated account representative, comprehensive household employee tax filing, tax document storage, and employee pay stub access. But at $220 a quarter (if you pay your nanny biweekly) or $245 a quarter (if you pay them weekly), HomeWork Solutions is on the pricier end of the nanny payroll spectrum.

The streamlined Essential Payroll plan costs a more affordable $165 a quarter (or $660 a year, closer to SurePayroll’s nanny payroll plan). This plan cuts out a few benefits, like tracking leave accrual, but it still includes key features like document storage that simplify end-of-year tax filing for busy employers.

HomePay: Best HR support

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

*Billed quarterly

Care.com’s HomePay might be the most comprehensive nanny tax company on our list. Along with calculating and filing taxes, the company offers HR assistance that keeps you in compliance with nanny payroll laws. Its budgeting feature makes it easy to figure out what you can afford nanny-wise while maximizing your tax return benefits, and its resource guides can help you decide what to pay your nanny and what benefits to offer.

HomePay also recently changed its pricing to $75 a month (billed quarterly). That doesn’t include a setup fee, but year-end tax preparation costs an additional $100, which brings your annual total to around $1,000.

Simple Nanny Payroll: Best calculator-only

Data as of 4/24/23. Offers and availability may vary by location and are subject to change.

Simple Nanny Payroll isn’t a full-service payroll option. Instead, it’s a DIY service that lets you calculate nanny payroll taxes and reach out to customer service for tax resources if you run into trouble. The payroll calculator is pretty handy, and the service costs only $29 for a full year. Simple Nanny Payroll isn’t too fancy, but it’s definitely a step above a spreadsheet. If you’re on a pretty limited budget and want to make sure you’re calculating taxes correctly, it’s a solid choice.

The takeaway

If you want a nanny payroll provider with simple software setup, helpful customer service, and reasonable pricing, SurePayroll's nanny payroll services are your best best.

SurePayroll is far from your only bet, though. Our other picks as the best nanny payroll services have a lot to recommend them:

- In general, Gusto has the same comprehensive features as SurePayroll. While it's plans are more expensive, its dedicated account specialists make tax payments much easier.

- Savvy Nanny is one of the more affordable nanny payroll choices, especially for household employers with two or more employees.

- Paychex has a host of competitive benefit add-ons for employers who want to offer a few extra perks.

- NannyPay is an excellent self-service option that helps ensure you're calculating paychecks correctly and withholding the right amount in taxes.

With the right nanny payroll service, your household hiring decision really can make life easier. Once you take the stress of paying taxes off the table, you can focus on your babysitter or nanny’s work, benefits, and happiness—and on enjoying the tax-free time your nanny tax software opens up for you.

Want help budgeting for your new household employee payroll service? Read our reviews of the year’s best personal finance budgeting tools.

Related reading

Still not sure which nanny payroll option to use?

Enter some basic information and we can assess your payroll needs to send you customized payroll software recommendations.

Nanny payroll 101

Have you just hired a household employee (like a nanny, gardener, cook, in-home nurse, or tutor) who will earn at least $2,400 from you this year? The federal government now considers you an employer, and that role comes with a host of new tax obligations. You'll play the same role as a traditional employer in some key ways:

- Calculating the right amount of payroll taxes to withhold from your employee's paycheck

- Filing those taxes and their associated paperwork with the federal government each quarter

- Sending required new hire documents to state authorities

- Applying for an employer identification number (EIN), which the government uses to recognize your business

If you think that sounds overwhelming at best, great news: nanny payroll software can take as many of these tasks as you'd like off your plate. The most fully featured payroll programs will calculate your nanny's paycheck, withhold the right amount of taxes, deposit the paycheck in your employee's account, prefill the quarterly and end-of-year tax forms you need to submit with your employee's taxes, and more.

Or, if you'd rather run payroll yourself, DIY software can calculate household employment taxes and set up direct deposit, then leave the actual payroll tax filing to you. The options we review below run the full range, from completely DIY nanny payroll to fully featured, totally automated software.

Nanny payroll service FAQ

SurePayroll is our favorite nanny payroll service. It’s one of the only payroll providers with a solid mobile app, which makes it both flexible and versatile. The software automates as many aspects of nanny payroll as possible, including direct deposit and tax remittance. It also costs $49.99 per month, which puts it on the cheaper end of full-service payroll.

However, the best nanny payroll service for you depends largely on what you need. Do you want to provide comprehensive benefits to your household employee? Paychex might be a better nanny tax service for you than SurePayroll. Are you comfortable handling most aspects of nanny payroll yourself? Simple Nanny Payroll could be the bare-bones solution you’re looking for.

The nanny tax is an umbrella term for the taxes you must withhold from your nanny’s paycheck and the employee tax contributions you need to match:

- FICA taxes, or the Social Security and Medicare taxes that both you and your employee pay

- FUTA taxes, or the federal unemployment insurance tax that only you pay, not your employee

You must pay these taxes (which means filing the amounts quarterly as well as at the end of the year) to maintain compliance with federal tax law.

If you're filing taxes at the start of 2022 for a household employee who worked for you in 2021, the Social Security tax payment is 6.2% of each paycheck and the Medicare tax payment is 1.45% of each paycheck.

If you pay your employee $2,300 or more per year, you’re required to withhold that amount from your employees’ wages to file with the federal government. You’ll also need to match your employees’ contribution out of your own pocket.

In contrast, only employers pay FUTA taxes—you should not withhold any taxes from your employee's paycheck to pay the FUTA tax, which is 6% of an employee’s first $7,000 of wages.

In other words, employers never pay more than $420 of the unemployment tax per employee. Plus, you’ll only pay the unemployment tax if your employee makes more than $1,000 per quarter.

Note that you are not required to withhold your nanny’s federal income tax or state income tax, though your household worker can directly requests that you do so. The IRS also lists some exceptions to nanny taxes, so before you start filing FICA, FUTA, and nanny taxes, give their list a read-through.

Do I need an EIN to pay my nanny?

Yes, you need an Employer Identification Number (EIN) for household payroll. To get an EIN, apply for one from the IRS—the application doesn’t cost anything and is fairly painless. Plus, if you apply online (the IRS’s preferred method, though you can also apply via mail or fax), you get your EIN immediately, which means your nanny will be able to start working for you right away.

(And, for the record, it’s always worth paying your nanny on the books. If you’re thinking of not applying for an EIN, reconsider—paying your nanny under the table is against the law.)

Can I pay my nanny through my small business?

No, you cannot run household employee payroll through your small business. If you become a household employer, the federal government requires you to obtain a new Employer Identification Number and pay employment taxes. Making small-business tax deductions based on a household employee’s salary is against the law and can result in hefty fines—it’s not worth the risk.

While hiring a nanny can certainly be a big help, most working parents still want to maximize the amount of time they’re able to spend with their kids.

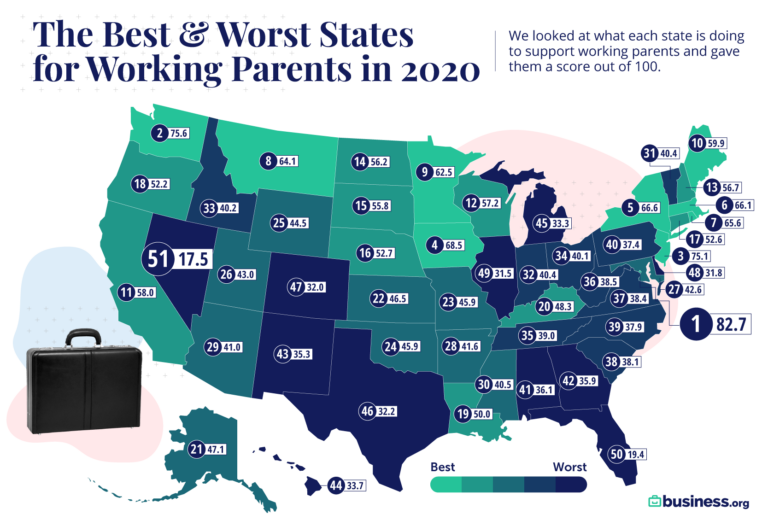

To do that, you need a positive combination of circumstances: family-friendly legislation that allows you to take time off when you need it and an income that can actually cover the cost of your housing. In this time of pandemic, it’s also really important to find an area with a stable job market with a low unemployment rate.

A lot of those factors depend heavily on where you live, so we took a look at the data to find out which states offer the best (and worst) environments for working parents.

Key Findings

- The District of Columbia is the most working parent–friendly area in the nation. D.C. offers all the job protections and family leave available in the U.S., meaning parents can usually take advantage of paid leave for medical reasons, maternity time, and paternity time. D.C. also has the lowest rent-to-income ratio in the country, meaning parents (theoretically) don’t have to spend as much time working in order to cover their housing costs—though we should note that this number may be skewed since most of the people making high incomes in the D.C. area don’t actually live in the low-cost neighborhoods within the District of Columbia.

- Nevada is ranked last for working parents. In addition to having a high cost of living and high unemployment rates, Nevada also doesn’t offer any legal benefits for parents other than the basic FMLA requirements.

- All three west coast states made it into the top 20 states for working parents. California and Washington both grant full legal protections for parents, while Oregon has a solid income-to-rent ratio and low unemployment.

The rankings

Methodology

We used the following criteria to rank our top nanny payroll picks:

- Pricing, including year-end tax filing fees, registration fees, and monthly or quarterly costs

- Customer service, including live chat options, hours of availability, email response times, and customer service ratings

- Hands-off automation, including options for automated payroll tax filing, end-of-year taxes, and payroll runs

- User-friendliness, including website accessibility, ease of use, mobile apps, and employee access portals

- Additional perks, including workers compensation and 401(k) options

- Tax services, including year-end tax filing guarantees, audit assistance, and tax filing help

To find out which states were best for working parents, we used data that might indicate parents in the area had more free time to spend with their children. Specifically, we looked for states that offered family-friendly legal protections, including paid family leave (paid maternity and paternity leave), paid medical leave, and various types of job-protected leave.

We also wanted to know which states offered the best ratio of income to housing costs (according to the U.S. Census Bureau), since a parent with a high income-to-rent ratio might not have to work as many hours to cover their family’s basic needs. We also looked at job stability during the coronavirus pandemic by examining the state’s change in unemployment rate over the past year (according to the Bureau of Labor Statistics).

We then weighted those numbers to prioritize the most important factors, using the most recent data available:'

- Gross rent as a percentage of household income (2019): 30%

- Unemployment rate change (Sept. 2019–Sept. 2020): 30%

- Paid family leave: 10%

- Paid medical leave: 10%

- Job-protected leave (lower employer size threshold): 10%

- Job-protected leave (lower employee tenure/hours worked requirement): 10%

We also wanted to note that since lower income-to-rent ratios and unemployment rates are preferable, states with the lowest numbers in these categories were scored higher.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.