💸 See if your business qualifies for a tax credit worth up to $26k per employee. 📞 Call Now: 855-979-9597

Breaking Down Business Startup Costs: What to Expect

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

When it comes to small-business ownership, you really do have to spend money to make money — which is why small-business owners often apply for loans from traditional lenders to get their businesses off the ground. But along with a business license, most traditional lenders require proof of revenue before they’ll agree to a loan. So how are new business owners supposed to start making money without qualifying for a business loan?

Well, for better or worse, most first-time business owners have to use their own money to launch their companies. And unless you have thousands of dollars of ready cash, this means you’ll probably need to take out a personal loan or turn to crowdfunding, credit cards, or alternative lenders to acquire enough capital to start your business (and start making money).

But the amount of money you need to start a business isn’t always clear. In fact, when we polled 700 small-business owners, more than 50% said they underestimated how much they’d have to spend during their first year of business to make money.

We'll dig into how much money you need to start a business and resources to help you budget for your first year of business.

How much revenue are small-business owners generating in their first year?

For most of the small-business owners we polled, their initial investment paid off:

- Online business owners average $50,000 in revenue their first year.

- Mobile business owners average $100,000 in revenue their first year.

- Storefront business owners average $105,000 in revenue their first year.

Remember that revenue isn’t the same thing as profit: Revenue is your business’ income, while profit is the amount of money you take home after paying for expenses, daily operations, employee paychecks, loan interest, and other debts.

The length of time it takes business owners to become profitable is usually a year or more — and only 15% of business owners polled started to turn a profit in under a year. Many business owners (40%) report turning a profit within their first or second year of business.

How much does it cost to start a business?

People tend to believe that starting a business requires an endless amount of money. On the contrary, freelancers, such as sole proprietors, and home-based businesses can get going for practically nothing.

These business ideas are perfect if you want a part-time business or a business that costs $1,000 to get going.

Other businesses, such as construction companies, trucking companies, restaurants, or franchises can have much higher startup costs.

So what costs will you face when you start your business? The answer, of course, depends on your business model.

Per our survey results, online-only business owners spend an average of $35,000 during their first year of business. But you might end up spending more depending on the type of business you start:

- Mobile business owners spent an average of $92,500

- Storefront business owners spent an average of $100,000

Bear in mind that most mobile and storefront business owners also operate online, which is one key reason they spend more than online-only business owners.

Which small-business expenses cost the most?

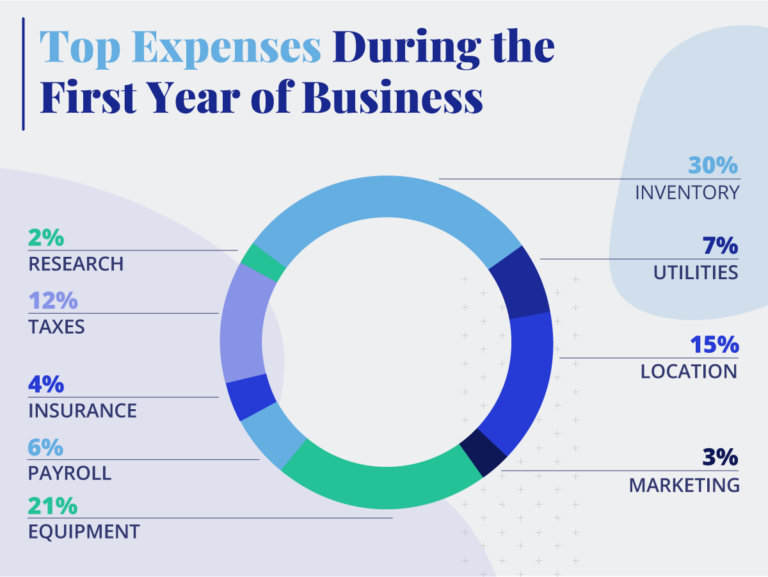

Startup costs are expenses of getting a business up and running. In our poll, we learned a lot about how first-time business owners spend their money in their first year of business. Here’s how first-year spending broke down for most business owners:

Other common costs included insurance, marketing, and research expenses — though, again, the amount of money spent on each type of expense depends on the type of business you start. If you own an online or mobile business, expect to spend more of your money on inventory. If you own a storefront business, you’ll probably spend more on location, such as renting, lease agreements, building repairs, and property taxes.

What are the most unexpected small-business expenses?

Inventory and equipment are fairly standard expenses, but first-time business owners also cope with unexpected expenses that can take a surprisingly hefty bite out of their budgets. For instance, 46% of business owners surveyed were surprised by the amount of money they had to spend on taxes. And 43% of our respondents were surprised by how much money they had to invest in technology, 40% were surprised by tech costs, and 39% were surprised by shipping costs.

Other costs that business owners didn’t always account for in their first-year budgets included licensing fees, insurance fees, legal fees, and patent costs.

By signing up I agree to the Terms of Use and Privacy Policy.

What startup expenses can I deduct from my taxes?

If you’ve officially started a business, you’re entitled to deduct specific startup costs and business expenses from your tax return. Any startup expenses you can't currently deduct have a 15-year amortization period (or a length of time allowed to write off expenses) from the first month you begin business. The IRS divides eligible startup costs into three different categories:

- Preparation costs: Before officially opening your doors, you’ll likely spend money on traveling, advertising, wages, or employee training. Business owners should treat these costs as capital expenses — which are all deductible.

- Research costs: Depending on your trade or business, you may need to perform research and survey certain markets to help your business succeed. Any costs associated with this type of research can be deducted.

- Legal and organizational costs: Setting up a partnership or corporation typically requires legal fees, accounting fees, state organizational fees, and filing fees. We know what you’re thinking — that’s a lot of fees. But these costs are 100% deductible.

What are funding options for small businesses?

To help your company thrive at every stage, you may need to find ways to externally fund your business. Working capital can help pay for expenses, one-time costs, full-time employees, and more. Here’s a roundup of funding options for your small business.

Friends and family

This is perhaps one of the most popular ways to find outside funding. However, if your business goes under and is unable to pay the loan back, be prepared to attend some rather awkward family gatherings. So it’s important to think long and hard before going down this road — regardless of the dollar amount.

Business loans

If you’re hesitant to reach out to friends or family, we have your next course of action. Consider applying for an online small-business loan to fuel your business. Most traditional banks and lenders like to see a personal credit score of at least 620. If you’re trying to work your way out of a credit score hole, we recommend microfinancing, otherwise known as microlending or microcredit. There are also a number of small business loans for startups that are great for brand-new businesses without cash flow or profit history. Regardless of your unique situation, the variety of loan options should encourage you and ease your worries.

Investors

If you’re looking for your personal Mark Cuban to be your angel investor for your small business, we recommend applying for Shark Tank. If that doesn’t work, we have the next best thing: crowdfunding sites like Kickstarter and Indiegogo can help you reach your funding goal. Equity crowdfunding, otherwise known as crown investing, connects you with potential investors who provide funds in exchange for a stake in the business. These new and innovative sites are truly lightning in a bottle.

If you’re lucky, an advisory firm may advise their clients to invest in your product or service. To show your investors that you’re serious about utilizing their capital, you’ll need a well-constructed startup financial model. It should not only be properly structured and compelling but also lay out financial projections, customer lifetime value, fundraising goals, unit economics, and expenses. And instead of reinventing the wheel, consider using a template.

Personal loans

This option should be your last resort. Although personal loans are a quick way to inject some cash into your business, they tend to be higher risk and more expensive. So if you end up going this route, it’s important to pay off the debt as soon as possible. Otherwise, you may harm your personal credit score.

Enter your loan needs and qualifications to get matched with a list of lenders best suited to you. Then, sort by the financing factor that you find most important. (Note: not all lenders allow personal loans for business use.)

Additional findings

Only 30% of new small-business owners we polled qualified for more traditional small-business loans. Among the remaining 70%, funding came from a variety of more personal sources:

- 39% used their personal savings to start their business.

- 33% used a personal loan.

- 34% used a personal credit card.

The takeaway

When it comes to startup costs, they can vary depending on your type and size of business.

More than 30% of the business owners we polled said starting their small business was one of the hardest things they’ve ever done. Whether you consider yourself part of that percentage or not, we hope our data helps you feel a little less alone.

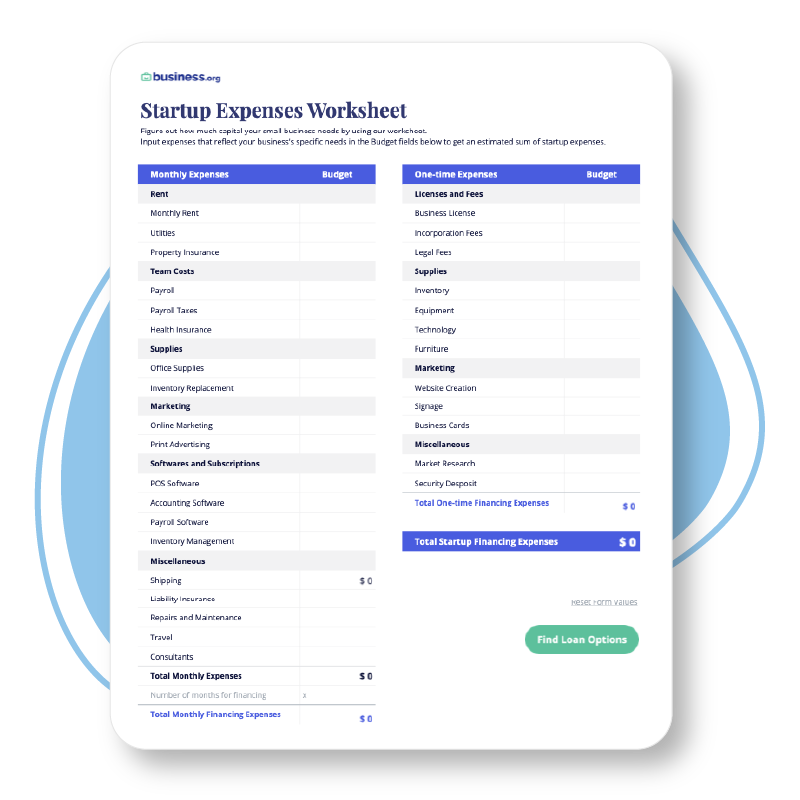

Finally, 51% of small-business owners polled said they wished they’d used a startup cost calculator before launching their businesses. If you want help budgeting for your first year of business, our startup cost calculator can get you started.

But no matter what your business ends up being, take the time to carefully estimate and plan for your startup expenses. It never hurts to be prepared.

Related reading

Methodology

We partnered with Pollfish to conduct an anonymous survey of 700 small-business owners. Our survey’s margin of error was +/- 2% with a confidence level of 95%. After working with Pollfish to collect survey data, Business.org analyzed the results and compiled this report. To learn more about Pollfish and how it organically finds poll respondents, check out its methodology.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.